When Everyone is Convinced of an Outcome, Be Careful

- cornerstoneams

- Oct 11, 2021

- 5 min read

CAMS Weekly View from the Corner – Week ending 10/8/21

October 11, 2021

Thinking back to late 2020 and into early 2021 there were a lot of narratives swirling throughout markets. Many of those narratives have fallen off the radar screen throughout the market landscapes and those that were barely on the radar screen are now seemingly the most prominent. Inflation as a general term is one that certainly comes to mind. Back in the aforementioned time period the topic of inflation was given little discussion even though in market landscapes we were seeing evidence that market participants were offering such a potential forward backdrop. Other narratives were certainly playing out in markets and even more so in media/political/societal discussions. There were none larger than the energy space. Seemingly, relatively overnight in fact, if you knew nothing of energy both as a market participant as well as a general citizen/consumer of energy it would have been easy to think that the stuff called fossil fuels was no longer needed. Turn it off – we are good kind of tone. In fact, pipelines had been shut down and operations of various entities producing any of the “legacy” energy sources were looked down on and in some cases openly threatened in various formats from legal fronts to outright personal attacks. Conversely, the general phrase of “green energy” was met with applause and open arms if you will. Wait; (think back there on the timeline) did someone say turning off pipelines as well as creating a general backdrop of disincentivizing the on-going extraction and production let alone the actual use of fossils? For our part it all made our ears perk up. Turning deaf ears to emotions and personal views as well as general societal views is an absolute must in market and socioeconomic analytics. The developing societal narrative and leadership actions taken to seemingly do everything possible to reduce supplies for an energy source that could not possibly be replaced quickly by current alternative technologies made us take note. Through the lens of supply and demand is that not a recipe for higher prices? Yes it is because challenging supply while maintaining on-going demand equals a supply/demand outcome of higher prices. Have you ever seen a big rig trucking company running their highway fleets with solar panels or a farm combine with a windmill attached? We are being absurd to state the obvious here: the “legacy” energy source could not possibly be turned off overnight even if we did have an alternative source that could completely replace it. It would take years for society to retool to the new source and that is if we had a viable source that could literally replace all the energy demands society currently places on fossils. Back To Markets With the above, markets were certainly off to the races late 2020 and early 2021 for green energy producers. The fossil producers participated in upside as well but their performance was half that of the green producers to begin the year. More specifically, the clear leader in markets was the solar space within the general green energy landscape. As always time tells her story and it does not always unfold according to the overwhelming consensus expectation. Markets seemingly always have a way of making sure that the “overwhelming consensus view” is taken out to the woodshed if you will.

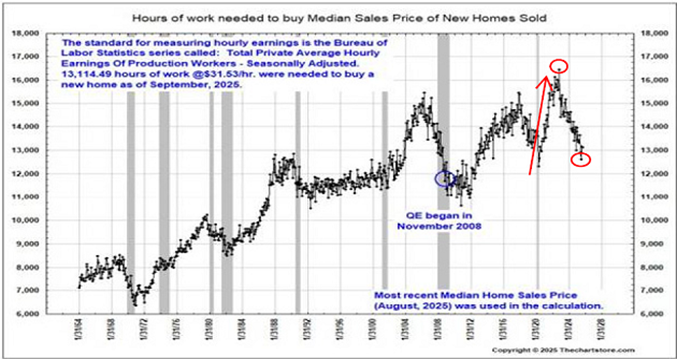

Click For Larger View: https://schrts.co/SHruTvgE

To share a visual of time telling her story thus far in the energy complex we share the above which dates back to the beginning of this year – 2021. Speaking to that “consensus view” theme we can conclude the opposite has unfolded as to what was expected. The black line in the chart are coal producers, the blue line are oil producers while the red line represents solar producers, which as stated, was the cream of the performance crop early on. Imagine back in early January if someone had told you that coal producers would perform at such an overwhelming pace that when placed on a chart with solar producers you would be hard pressed to be able to accurately identify which was which relative to the then consensus expectation. Current Collective Beliefs Speaking to our general theme of consensus expectations being met with a different end-result reality we ask what are some current day consensus beliefs? We name a few that come to mind. Price inflation is transitory (this has been going on for months begging the question – what does transitory actually mean?). The Federal Reserve will cut their money printing “soon” (using their most recent official narrative) with the consensus belief of such an outcome intact. The stock market is fine – nothing to worry about here (against a valuation backdrop that is hard to compare to at any time in history – meaning stocks are priced to the stratosphere). The bond market is a safe alternative if stocks have a problem (even with bonds also priced to the stratosphere when viewing their yields through a “real yield” historical prism – which means when factoring in price inflation they are losing money with the amount of interest they pay – including many high yielding “junk” bonds). Supply shortages will ease up and go away once we fully reopen (even while central authorities have incentivized millions of people to participate less in the employment market forgetting it is people who create supply as supply does not just magically appear). These are just a few larger consensus themes. We offer them for your own contemplation fully removed from emotion and bias. Will they unfold as expected? Perhaps. But we know how time telling her story can and often does surprise the most people. With this, think through options if the above narratives do not unfold as expected. We certainly are in managing our way through these and other narratives and hence market landscapes. I wish you well…

Ken Reinhart

Director, Market Research & Portfolio Analysis

Footnote:

H&UP’s is a quick summation of a rating system for SPX9 (abbreviation encompassing 9 Sectors of the S&P 500 with 107 sub-groups within those 9 sectors) that quickly references the percentage that is deemed healthy and higher (H&UP). This comes from the proprietary “V-NN” ranking system that is composed of 4 ratings which are “V-H-N-or NN”. A “V” or an “H” is a positive or constructive rank for said sector or sub-group within the sectors.

This commentary is presented only to provide perspectives on investment strategies and opportunities. The material contains opinions of the author, which are subject to markets change without notice. Statements concerning financial market trends are based on current market conditions which fluctuate. References to specific securities and issuers are for descriptive purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. There is no guarantee that any investment strategy will work under all market conditions. Each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market. PERFORMANCE IS NOT GUARANTEED AND LOSSES CAN OCCUR WITH ANY INVESTMENT STRATEGY.

Comments