Collective Market Participant's Offer Their View on the Housing Market

- cornerstoneams

- Feb 26, 2024

- 5 min read

CAMS Weekly View from the Corner - Week ending 2/23/24

February 26, 2024

It is getting a bit hard to keep up with and to succinctly express broad econ narratives with each passing day in light of their rapid evolutions via new additions brought on by unfolding economic realities. This is even more difficult when it comes to a relative micro topic of the economic/market(s) landscape.

The housing market is certainly a more drilled down topic than say the broad economic landscape so we tread lightly with the assumption that we know for certain what the consensus outlook is for the housing market. It is just hard to keep up.

We think it goes something like the housing market is a notable problem or at least is developing into being a notable problem that can or will, depending on the commentary, develop into a housing debacle that in some form or fashion elicits the memories of 2008/09.

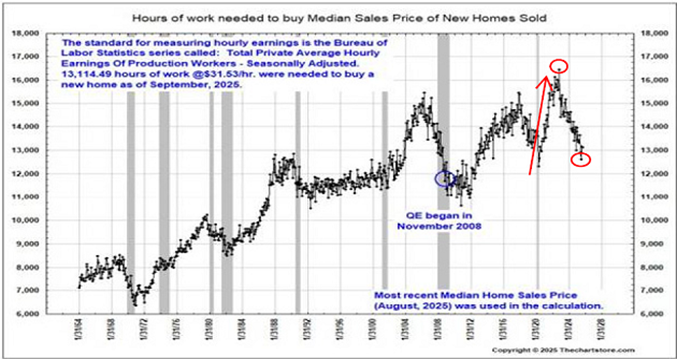

To be certain what is very obvious and has been obvious is how evermore of the citizenry is challenged with meeting their housing needs relative to pricing. From leases to rents to purchases housing costs are taking up an ever larger portion of household budgets. Think price inflation.

This story has been unfolding for many years as ridiculously low interest rate policies set the stage for off the charts housing/land (and every other asset class) speculation. This is to be expected when interest rates are set below the rate of price inflation, not for months but for the vast majority of the 21st century. Crazy but true.

History offers such a policy stance invites over the top speculation as the currency’s downstream purchasing power gets questioned, the economics of basic savings gets discouraged while taking on debt gets encouraged and through it all asset pricing - when looked at through a valuation lens - becomes unrecognizable in light of the price levels in you name it asset class.

So it is not a discussion topic as to whether housing (or nearly any asset class) is too expensive – they are all too expensive in light of the above 21st century interest rate storyline – the topic under consideration is whether collective market participants continue to see the general housing market as viable and will it hold up in the opinion of their forward looking view?

For this discussion it is important to keep in mind that collective market participants always look out into the future and price assets today according to what they see (or think they see) unfolding socioeconomically downstream. Their vision does not come with guaranteed certainty as though it is a lock as many market corrections can attest to over the years and decades.

What it does come with is a message current day as to what they believe the near-term future looks like for whatever area is under review. They do get it wrong and sometimes through runaway exuberance they get way out in front of themselves and through this really get it wrong. Regardless, there is a message to be viewed so let’s check in on their housing view.

The above depicts the Dow Jones U.S. Home Construction Index dating back 18 months. This walks us back to a chunk of time in 2022, all of 2023 and thus far in 2024.

We offer this relatively recent time to get a sense of how market participants have viewed this space up to current day as they underline their forward views not with a simply offered opinion but rather with capital placed down on the space by taking ownership stakes in the shares of companies producing homes.

This elicits the old phrase, “Money talks, BS walks” offering it is easy to talk right but if that talk is backed up by capital then that is a whole different level of conviction - and usually a whole different level of due diligence that stands behind it - which enhances the messaging of collective market participants.

In the above chart our arrows highlight the process of the overall uptrend of this space in the previous 18 months.

With assistance from the rearview mirror what we can offer with certainty is circa 18 months ago the consensus was lathered up with the view that housing was doomed in light of rapid interest rate increases from the Fed. Clearly that has not happened.

Interestingly, per the above chart and participant’s forward view, they don’t see it happening anytime soon. Note our red box depicting pricing behavior in the previous few months. If anything we are seeing a challenge by participants to break this index higher whereby it would be continuing its established uptrend.

Simultaneous to the above the Dow Jones Home Improvement Retailer Index has carved out a somewhat similar chart view over the previous 18 months but unlike the above Home Construction Index, the Home Improvement Retailer Index has pushed higher here in February and in so doing has continued its upward trend.

As a note worth taking this is not the type of language used when discussing a crashing market or a near-term expectation of a crashing market.

The Harbinger of 2008/09 Showed Itself in 2006/07

We emphasize, once again, the essence of market participation is a focus on the forward looking view. Collectively, market participants constantly strive to ascertain what the downstream socioeconomic reality will look like and then price assets today according to that view.

Circa 2006/07 participants were offering the housing market had issues heading its way - notable issues. Interestingly, this was at the same time that society came to believe in droves that housing could not only ever go down but would provide endless riches for the masses for as far as the eye could see.

Just keep hitting that RE–FI button, your home is an ATM that can be counted on to keep delivering the cash when needed - reminiscing on one aspect of that era. Collectively, society vehemently believed this message.

Collective participants couldn’t have disagreed more back then.

Above is the Dow Jones U.S. Home Construction Index – the same Index as offered up above. This chart covers mid-2005 through 2006 and 2007 for some pre-2008/09 perspective.

Our red arrows note the overall downtrend in prices which underlines collective market participant messaging for this space back then.

Well before the obvious, circa 2008/09, participants were consistently offering housing had a problem heading right for it but few were interested in listening – narrative certainty had no time for such evidence.

Simultaneous to the above the Dow Jones Home Improvement Retailer Index carved out a somewhat similar chart view back then further corroborating the messaging from collective participants that housing was a dead man walking. Both indexes went on to much lower lows as the timeline walked into and through 2009.

Back to current day the messaging from market participants is the near-term outlook for the housing market is anything but a crash or even a notable drawdown. We watch this with a growing intrigue.

Don’t they realize the interest rate cuts for as far as the eye can see narrative is imploding in light of on-going price inflation and economic growth? Of course they do. Don’t they realize the world as we know it, any week or month now may be or will be imploding because of general societal discontent? Of course they do. We could continue but you get the point.

They see it all and yet they are “looking through it” as it is referred to in the analytics game.

Perhaps they are focused on a seemingly much larger and certainly more basic issue. Reduced to simplicity, perhaps they are concluding we have a housing issue – as in not enough housing – and through this basic assessment when supply is not prevalent enough to meet demand it is extremely hard for prices and the market in question to collapse.

It just may be that simple and yet complex.

As always, time will fill in the holes but for now participant’s messaging offers the housing market is not in imminent trouble.

I wish you well…

Ken Reinhart

Director, Market Research & Portfolio Analysis

Comments