The Market Gives Her Opinion on Your Future Consumption Priorities

- cornerstoneams

- Mar 7, 2022

- 4 min read

CAMS Weekly View from the Corner – Week ending 3/4/2022

March 7, 2022

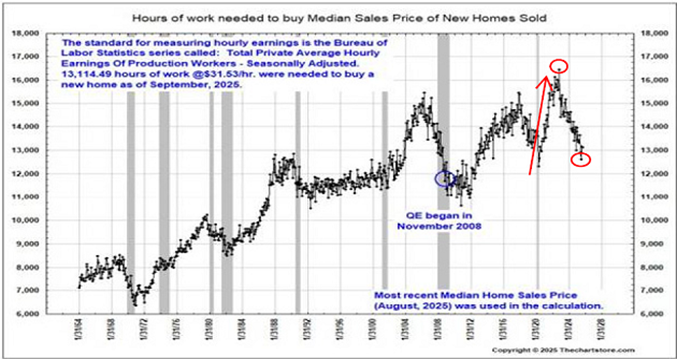

These editions have included the topic or phrase “price inflation” more in the previous year than the combined total since inception. This is obviously not a new topic for our publication here and yet what we have emphasized over the previous year, as an on-going concern, has been ramped up even further in recent months per the forward looking view of markets. The past couple of weeks in particular have been downright ugly relative to price inflation and its impact to the consumer in all of us. With this, the wage earner in us, even with the current employment market offering jobs-a-plenty will be quite challenged when placing their wage rate gains against price inflation gains. Said succinctly, society is and will be getting poorer. On the employment topic we seen 678,000 jobs created for February as of Friday’s employment report. Inside the report we also seen year-over-year wage gains dropped from the previous report’s 5.5% gain to the newly released figure of 5.1%. This compares to the most recent price inflation report depicting 7.5% increases which, per the market’s message in recent days/weeks, can be expected to increase further. Placing the above storyline together you see how we offer society will be getting poorer as the wage earner in us is challenged to bring home wage rates that allow the consumer in us to functionally navigate price inflation levels. Simply, the near-future purchasing power of our dollar is looking like a continued downtrend – the other and more accurate way to state “price inflation.” Collective Market Participant’s View Market participants are constantly digesting the broad landscape then in-turn point to where this is heading by pricing assets today according to what they see and expect. They express their views through the pricing of assets, commodities and even interest rates. As they assess their forward views and see, for example, bushels of corn will not be as plentiful as needed relative to expected demand for corn they will begin pushing up prices of corn now with an expectation that it will be scarcer relative to the demand for corn in the future. Simultaneously, with their conclusions showing up in the price, market suppliers can see their price signal and choose to “chase that price” by deciding to increase the amount of corn offered by planting more corn relative to some other agricultural crop. With this, the story of supply relative to demand and hence the relative scarcity of X product unfolds as days and weeks roll onward. With the above brief description in mind we can look at what market participants are expecting by looking at the price performance of broad swaths of various markets and then can also glean broad messages from their pricing trends relative to what they expect society to look like down the timeline. Participants have been telling us over the previous year that we will be prioritizing our purchases of food and energy to the detriment of items that are considered more frivolous such as consumer discretionary items. By zooming in our time reference to more recently we can see what they are suggesting to society near-term per their “spoken message” by the pricing signals they are leaving in their wake.

Click Link for larger View: https://schrts.co/JQbXIsgM

The above chart depicts the price performance thus far in 2022 of three notable areas of markets that also speak to an expected general societal experience. The three lines represent the price performance of oil, a basket of broad agricultural commodities and a basket of consumer discretionary companies. Oil and food are up double digits (54% & 11% respectively) in 2022 while the consumer discretionary basket is down double digits (14%.) With the three together market participants are offering that in light of the expected increasing scarcity of oil and food in conjunction with the already existing wage rate challenge relative to price inflation that the consumer in us will be forced to prioritize food and energy to the detriment of our discretionary purchases. Stating the obvious, their messaging is that we as citizens will be more focused on using our decreased purchasing power to prioritize powering our homes and autos and keeping ourselves fed than we will be on purchasing a new couch as an example. As offered previously, society will be getting poorer per their messaging. When our consumer dollars are evermore eaten up by necessities relative to “fun purchases” we can offer as a working definition that society will be experiencing impoverishment, i.e. getting poorer as consumers are forced to prioritize necessities. Collective market participants are not offering us an upbeat message but this is the expected experience they are painting for us via the price trends they are leaving in their wake across multiple markets. I wish you well…

Ken Reinhart

Director, Market Research & Portfolio Analysis

Footnote:

H&UP’s is a quick summation of a rating system for SPX9 (abbreviation encompassing 9 Sectors of the S&P 500 with 107 sub-groups within those 9 sectors) that quickly references the percentage that is deemed healthy and higher (H&UP). This comes from the proprietary “V-NN” ranking system that is composed of 4 ratings which are “V-H-N-or NN”. A “V” or an “H” is a positive or constructive rank for said sector or sub-group within the sectors.

This commentary is presented only to provide perspectives on investment strategies and opportunities. The material contains opinions of the author, which are subject to markets change without notice. Statements concerning financial market trends are based on current market conditions which fluctuate. References to specific securities and issuers are for descriptive purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. There is no guarantee that any investment strategy will work under all market conditions. Each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market. PERFORMANCE IS NOT GUARANTEED AND LOSSES CAN OCCUR WITH ANY INVESTMENT STRATEGY.

Comments