Stay Nimble Be Safe

- cornerstoneams

- Feb 8, 2021

- 4 min read

CAMS Weekly View from the Corner – Week ending 2/5/21

February 8, 2021

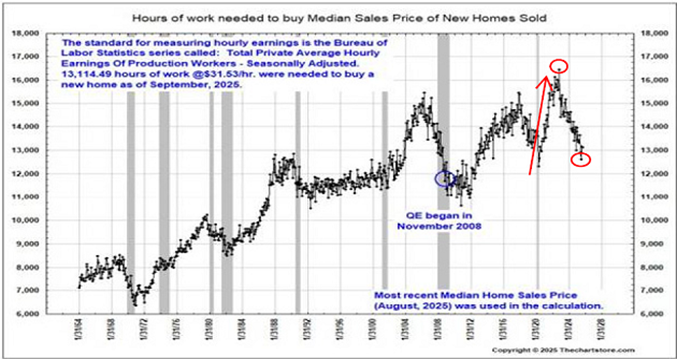

The well known road sign offering “Yield” to vehicle operators as they approach is a subjective sign. It certainly offers guidance, i.e. to yield to other vehicles for an upcoming through-way and yet it is not steadfast such as the stop sign. It basically offers to use discretion while informing operators to heighten their attention. This is analogous to our subject title. It does not offer steadfast guidance but simultaneously offers; “hey, pay attention” in this through-way on the proverbial market roadway. Money Printing/Indebtedness – Interest Rates – Speculation In recent editions we have offered various aspects of market related observations as well as forward thought experiments. In a cumulative wrapper they offered massive money printing/indebtedness, interest rates and speculation. The money printing/indebtedness is off the rails as yet another $1.9 Trillion relief package has been pushed forward as of late last week. In less than twelve months we’ve seen Trillion dollar plus packages pushed out every few months. That is a monstrosity of printed money and indebtedness. As all know, there is no stash of cash for rainy days lying around, rather, it is up to the printing press and new debt to fund said packages. Weak Employment Market? Interestingly, in speaking with various connections of large, unrelated industry employers they share a consistent labor experience. Succinctly, they need additional people and cannot attract them. As shared with me, through their research through their labor networks, people are waiting on more stimulus money coupled with enjoying their increased unemployment benefits. The two combined seem to be playing a notable role in various companies’ inability to attract employees. With this, is the employment market truly weak? The paltry number of new jobs added in the month of January certainly implies it is. This past Friday the monthly employment report suggested just that. Rather, is it much stronger than what the new jobs numbers reflected because employers are unable to find employees? To appreciate this you have to hear the tone of “x” person emphasizing how bad they need people while simultaneously exasperated they cannot find enough relative to the amount needed. Circling back to the money printing/indebtedness, the Treasury bond market continues to take notice of the massive stimulus packages as they continue to sell off which means interest rates are rising as a result. As bond prices go lower in price the interest rate moves upward. If it turns into a solid trend will markets be able to hold up while interest rates are consistently trending upward? This is an important and yet unanswerable question at this point as there are many variables that circle around that inter-market relationship. Speculation The money printing takes us to the speculative backdrop that has taken hold inside the stock market. For example, penny stocks and micro cap stocks (i.e. real small companies) are not trending higher but rather are missile launching higher. Yet again, through the lens of history, speculation going off the rails shows itself when these areas, en masse, are taking off skyward. What is the problem with feverish speculation within a market landscape? Such a backdrop offers the market in question is in late innings of its upward run. The problem is such a backdrop doesn’t inform us as to which inning we are in. Is it top of the seventh implying there is a notable amount of time remaining and a wealth of upside yet to unfold? Conversely, is it the bottom of the ninth with two outs and the batter at the plate has a two strike count against him? From the money printing/indebtedness to the Treasury bond market’s ability to handle the growing indebtedness while simultaneously observing rampant speculation inside the stock market offers a unique landscape that can turn into a real problem without much notice. This is not a prediction but rather an observation based on historical precedent throughout market history. If there was ever a time to heighten your market awareness, similar to the yield sign while driving, these are such times. As Ron Griess, a five-plus decade market operator over at The Chart Store likes to offer: Stay nimble be safe. I wish you well…

Ken Reinhart

Director, Market Research & Portfolio Analysis

Footnote:

H&UP’s is a quick summation of a rating system for SPX9 (abbreviation encompassing 9 Sectors of the S&P 500 with 107 sub-groups within those 9 sectors) that quickly references the percentage that is deemed healthy and higher (H&UP). This comes from the proprietary “V-NN” ranking system that is composed of 4 ratings which are “V-H-N-or NN”. A “V” or an “H” is a positive or constructive rank for said sector or sub-group within the sectors.

This commentary is presented only to provide perspectives on investment strategies and opportunities. The material contains opinions of the author, which are subject to markets change without notice. Statements concerning financial market trends are based on current market conditions which fluctuate. References to specific securities and issuers are for descriptive purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. There is no guarantee that any investment strategy will work under all market conditions. Each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market. PERFORMANCE IS NOT GUARANTEED AND LOSSES CAN OCCUR WITH ANY INVESTMENT STRATEGY.

Comments